Pre-retirement planning is one of the most challenging stages of your financial journey. You’re still fully engaged in your career, but you’re also looking ahead to a not-distant future when your life and your source of income will radically change.

Retirement means you’ll be making choices about where you want to live, what your retired life will look like, if it will include work, travel, charity, a hobby – all the things you always wished you had time for will now be yours to choose from.

But you’re also going to need to ensure you have enough saved to fund the retirement you want, and that the income stream you’ll be able to generate from all your sources of income in retirement is tax-efficient.

You also want your retirement plan to be flexible, so that you can make changes along the way. The key to the last few years of work is a strong cash planning game. It can help you wisely use the higher income you are making in the last few years of your career, and can help you make good choices around when to retire and how to shift your income.

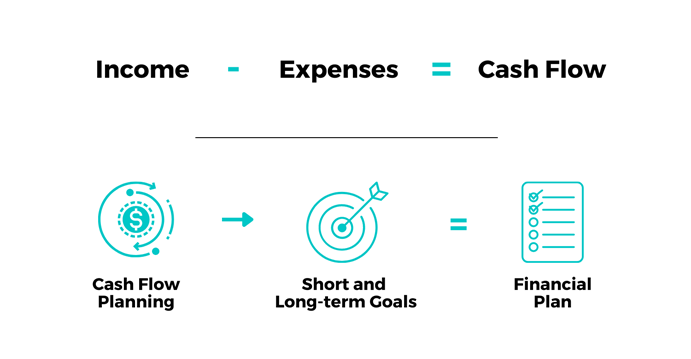

Cash flow planning is the foundation of your financial plan, and it needs to be specific to the stage you are in.

Understanding the Planning Mindset

While budgeting is part of cash flow planning, the goals of each are very different. Budgeting is about making choices to keep spending in check, with almost a scarcity mindset. It is about current expenses and works best over a short-term time horizon. Cash flow planning looks at the short-term and the long-term. It is a tool to help you make decisions that will help you achieve future goals. The process helps you identify future income and expenses and plan for big-ticket items. The result becomes part of your financial plan and dictates changes to across your financial plan. Understanding and detailing your flows keeps your investments tracking. It ensures you are realistic about return opportunities and gets you thinking big picture, including minimizing taxes and protecting your assets. When you’re in the pre-retirement stage, cash flow planning is particularly useful because it can help you see how your current spending will translate to your retirement spending. These last few years of income are critical to ensuring you can fund your retirement goals, you need to understand your spending, saving and investing so you can optimize between doing things you want to do now, and investing additional funds for later.

Getting Into the Process and Tactics

Income minus expenses equal cash flow. It’s as simple as that.

Start With Your Income

This means monthly net income after taxes, across all sources, including salary, rental income, reliable investment income, etc.

Identify Your Expenses

These usually break down as follows:

- Debt including credit cards, leases, mortgage payments, and loans (personal, education, etc)

- Taxes except for salary taxes, which is covered in net income

- Basic monthly expenses: Rent, food, gas, cable, phone, etc.

- Discretionary expenses: Dinners, trips, purchases

- Savings: Cash reserve savings, retirement or education savings, big-purchase savings

- Insurance costs: Home, health, professional liability, auto, potential umbrella policy

- Extraordinary expenses: Anything out of the norm – vet bill, car repair, etc. To get a realistic annual figure, average the last three years of these

Set Clear Goals

Spend some time identifying short- and long-term goals between now and when you want to retire and assign spending targets to them. The first one to address is your level of retirement savings. If you don’t think you have enough saved, maximizing tax-advantaged savings and savings extra in taxable accounts is the first priority. If you feel comfortable with the level of your portfolio, goals for these last few years could be paying off your mortgage, funding 529 plans for grandkids educations, starting a business once you’re retired, or even buying a vacation home or renovating your existing home.

Developing and working towards goals is the essence of cash flow planning. While budgeting operates from a scarcity mindset of cutting expenses, cash flow planning opens up the horizon to allow you to see clearly where you are now and where you want to go. The purpose behind identifying both short-term and long-term goals is that the ends to achieve them are different.

Deploying Your Cash Flow Planning Strategy

The planning part links your cash flow to your future expenses, to help you achieve your goals. The process uses the outcome of your cash flow planning to create a road map to get to each goal. Different strategies are devised for each to guide better outcomes. When done correctly it can uncover gaps in your financial plan. For example:

- Are you taking enough investment risk with your investments, whether in your retirement accounts or taxable accounts? When you are close to retirement, you usually want to cut risk – but you need to assess if that works for you

- Should you refinance debt, or work to pay it off more quickly to reduce income needs in retirement?

- Are you minimizing your taxes through tax-advantaged saving vehicles like health spending accounts?

- Should you diversify your income stream or invest in more tax-efficient sources of income, such as real estate?

When deploying your cash flow planning strategy, it’s essential to do check-ins against your goals and tactics to get you there. As part of your cash planning review, you should look at ways to automate as much as possible. Getting the right systems in place can ensure you hit savings goals and save as much as possible for retirement.

The Takeaway

As your financial journey unfolds, it’s important to ensure that it keeps up with your life. As you change and grow, your goals will evolve, and your resources often increase. Ensuring that your planning matches your life stage is critical to growing wealth and staying on track as you move forward.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.