Envision Financial Planning

Secure Your Future: Proactive Financial Planning Techniques

Whether you’re a new college graduate or an established professional, it’s never too early to start saving for your retirement. As one might expect, the longer you live, the more resources you’ll need to sustain your lifestyle, so it’s always a good idea to start saving sooner rather than later. When saving money for your […]

Pandemics, as rare as they are, have made their mark in history – not only in numbers of lives claimed but in the economic impact felt around the globe. As we’re all facing the market downturn and recent financial volatility caused by the spread of COVID-19, it’s useful to look back at how the economy […]

On March 27, 2020, President Donald Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act. Amidst the global COVID-19 pandemic, this act is designed to bring economic relief to individuals and businesses who’ve been affected by the resulting economic downturn. Section 2202 of the act, titled “Special Rules For Use […]

As COVID-19 continues to run rampant in the United States, individuals everywhere are experiencing emotional, physical and economical implications. In an effort to ease the pandemic’s detrimental effects, the federal government has recently passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Included in this act are hospital funds, extended unemployment insurance, extended lending […]

With coronavirus fears growing, millions of homeowners have been receiving surprisingly good news as mortgage rates continue to hit new record lows. As of April 2, 2020, the national average rate for a 30-year mortgage has fallen to 3.33 percent, with an average of 0.7 points paid, according to data from Freddie Mac.1 Mortgage rates have […]

As COVID-19 continues to spread throughout the globe, individuals are adjusting to new lifestyles in an effort to curb the spread. While there are many factors of this pandemic we cannot control, practicing social distancing and creating new routines to remain physically and psychologically healthy are just a few of the actions we can take. Virtually every […]

Remaining in quarantine for an extended amount of time is a challenge. Everyone reacts differently to stressful situations, but there are things we can all do to remain mentally strong. Below we’re offering eight tips to help anyone better manage their mental health while social distancing at home. Tip #1: Take Breaks from the […]

With the onset of COVID-19 in America, investors saw the 11-year run of our bull market come to an end on March 11, 2020. As we entered a bear market, the Dow Jones Industrial Average experienced a more than 20 percent drop in March from its recent high on February 12, 2020.1 While many investors […]

On Friday, April 24, 2020, President Donald Trump signed the Paycheck Protection Program and Health Care Enhancement Act amidst the continuing COVID-19 pandemic. This $484 billion relief package comes less than a month after the historic $2 trillion Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, which offered relief funds for businesses, families, […]

The coronavirus has had an immense impact on our physical well-being, as well as the economic health of individuals and families across the globe. Businesses are being forced to cease operation, leaving people worldwide jobless at record rates. Roughly 22 million Americans filed unemployment claims over a four-week period starting March 14 – marking a […]

Just entering the workforce or winding down toward retirement – it doesn’t matter where you are in your career, it’s likely COVID-19 has made its mark on your professional and financial life. But for those between the ages of 62 and 70, you have the opportunity to begin claiming your Social Security benefits, whether you […]

As millions around the globe continue to work from home, it’s important to remain vigilant when it comes to staying safe online. Here are eight cybersecurity tips that you can start utilizing today. Tip #1: Encrypt Sensitive Data in Your Emails If your position at work requires you to send sensitive information regularly, it’s important […]

For millions, the pandemic has served as a source of financial distress and worry. This rings true, in particular, for investors of all kinds. Market volatility is the highest it’s been since Black Monday, over 30 years ago – not to mention the fact that this is the largest volatility spike linked to a disease […]

Although COVID-19 related restrictions are beginning to ease, many people continue to help slow the spread by staying home and self-isolating. There are still unknowns related to the pandemic and how it will play out, undoubtedly keeping us all on edge. Over the past few months, we’ve been forced to face fears of falling ill, […]

“It turns out my job was not to find great investments, but to help create great investors,” writes Carl Richards, author of “The Behavior Gap.”1 From increasing our budget mindfulness to taking a steadier approach to investing, Richards has drawn attention to the way our unexamined behaviors and emotions can be our detriment when it comes […]

The COVID-19 pandemic is changing our world, and there’s no answer for when we’ll be able to resume life as we knew it before. One major change in question is the future of universities and how students, especially incoming freshmen, can expect to receive higher education. This year, colleges across America transitioned to remote learning […]

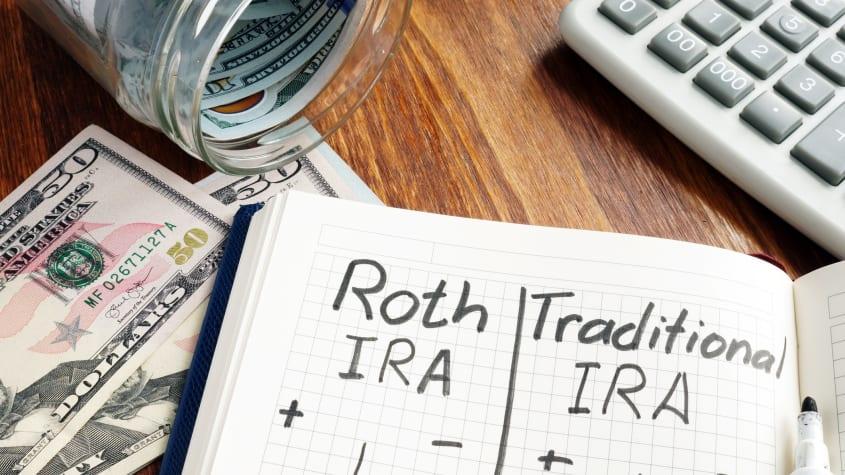

When opening a retirement savings account, you’re typically presented with the option of choosing between a traditional or Roth IRA. While you may have stuck with a traditional IRA for the initial tax savings, it’s possible you could change your mind and opt for tax-free retirement income instead. Making this switch is called a Roth […]

One of the biggest fears of any new or seasoned investor is losing money. This fear can actually inhibit some people from ever investing at all, and it might also lead to selling preemptively or opting for the lower risk investment option time and again. To minimize the fear of losing money, investors sometimes choose […]

When we think of financial health, a few things might come to mind. We may think of our own financial status, our investments, the Dow Jones Industrial Average performance, the stock market as a whole, the economy, the country’s employment status and so on. While some aspects may be interrelated on some level, they are […]

We all know we need a will so that our affairs will be in order and our last wishes carried out once we have passed on. But did you know you have options when it comes to creating a will? You may have heard that you can actually do-it-yourself when it comes to creating a […]

Since there is no exact timeline on how long we will live or what our future may hold, it’s understandable to have questions and concerns about the road ahead. Whether you are already retired or just beginning to consider your retirement years, the question “Will I outlive my money” is most likely a top concern. Thankfully, […]

Since August 15, 2020, California has been battling wildfires of historical proportions. Within two weeks, wildfires destroyed over 1.35 million acres of land – that’s six times the size of New York City.1 As of late August, more than 1,852 homes and businesses have been destroyed. Whether you’re currently residing in California, own property there or […]

The average annual healthcare expense per individual rises from roughly $2,000 for 19-year-olds to about $11,000 for retirees (age 65+).1 As Americans pay more for medical care, they often seek ways to save for emergencies. Health savings accounts (HSAs) and health reimbursement accounts (HRAs) can help. What are these accounts and who has access to them? […]

Having at least a basic insurance plan is essential for anyone. While many jobs cover your insurance needs, not all of them do. It’s important to figure out what insurance plans you need and what works best for you and your family. Choosing an insurance plan can be complicated, so when doing so, try to […]

Medicare’s open enrollment period happens once a year between October 15 and December 7. During this time, current Medicare beneficiaries have the option to adjust their coverage for the coming year. This can be a useful option for those who may have recently changed medication, underutilized their current coverage or found they could use additional […]

Open enrollment (the annual period where you can enroll in major medical health insurance plans), begins November 1, 2020 and will remain open for 45 days, or until December 15. For someone looking to change or add coverage, this offers a short window of time to decide on and select your health insurance plan. Before […]

Sex, lies and accusations of corruption – no election year is complete without them. And while the 2020 election has proven to be one of the most contentious in recent history, contention is nothing new in the world of politics. From the political match-up of Jefferson v. Adams to this year’s Biden v. Trump, mud […]

2020 has been quite the year, to say the least. With only one month left, everyone is ready to put the year behind us and try to start fresh. From the coronavirus pandemic to economic shut downs, many have felt the financial strain. If you are looking to start 2021 off on a better financial […]

The coronavirus pandemic has been hard on everyone this year, and we’ll continue to see big adjustments in our everyday lives for months to come. Whether you’ve personally battled the illness, faced financial difficulties or postponed important plans, it has not been easy on anyone. But this doesn’t mean you should simply stop planning for […]

Classic investments, like stocks, are not the only investments taxed by capital gains. Capital gains taxes can apply to any other property that acquires value over time. These taxes are calculated by subtracting the cost of the investment from the final selling price of said investment. This final amount is reported as capital gains. But, […]

Equity compensation is an alternative compensation strategy designed to provide employees with investment opportunities through company-based stock options. Over the years, this strategy has become more popular. In fact, according to Harvard Law School, roughly 58 percent of CEO compensation is a mix of equity and cash as of 2019.1 An equity compensation strategy is […]

On Monday, Feb. 22, the Biden Administration announced several changes to the popular Paycheck Protection Program (PPP) – some of which went into effect as of Feb. 24. According to a White House press release, these changes are intended to further target “the smallest businesses and those that have been left behind in previous relief […]

Deciding when to begin claiming your Social Security benefits will depend on several factors, such as your personal health and financial standings. It’s true that waiting to access benefits will increase your monthly payments down the road. But, full access will depend on your birth date and some may need to access benefits sooner. To […]

One year into the pandemic, individuals everywhere are experiencing emotional, physical and economical implications. In an effort to ease the pandemic’s detrimental effects, the federal government has recently passed a third stimulus package called the American Rescue Plan Act. Eligible individuals and families will receive stimulus checks up to $1,400 per person. As a reminder, […]

One year into the pandemic, Americans are continuing to strike a balance between staying safe and handling their day-to-day responsibilities. One major challenge we all face this time of year (pandemic or no pandemic) is filing our taxes on time. On March 17, less than one month until Tax Day, the IRS announced an extension […]

Donor-advised funds, or DAFs, allow families and individuals to make tax-advantaged donations to charitable organizations. Similar to other investment accounts, a DAF allows donors to contribute assets to be donated to charitable organizations. The IRS requires such funds to be operated by 501(c)(3) organizations, or what the IRS deems “sponsoring organizations.”1 Below we’re breaking down […]

On March 31, the Biden administration announced their proposal for a $2.2 trillion infrastructure bill called the American Jobs Plan. According to the official fact sheet, the American Jobs Plan aims to “create millions of good jobs, rebuild our country’s infrastructure, and position the United States to out-compete China.”1 This historic bill offers an expansive […]

Following a year of economic instability, it appears that many of us are turning our attention to something that’s been around for decades, but has recently piqued national interest – inflation. In fact, a recent study found that people are Googling the word “inflation” at a rapid rate, with a peak not seen since 2008.1 […]

Whether you’ve officially retired or are still working full time, it’s possible your health insurance options are changing. Depending on your age or health status, you may soon be qualified for Medicare. While you’ve likely heard of it before, we’re breaking down what exactly it is, who Medicare benefits and what each Medicare part covers. […]

Money is the second leading cause of stress amongst adults.1 If you find yourself worried about your financial wellbeing, you’re not alone – and there are things you can do to make it better. Financial stress can stop even the most productive people in their tracks, causing sleepless nights, avoidance of debt and denial. Here are […]

It’s common for people to want to leave money behind for their children and family members after death. After spending years working to earn a living, people are proud to leave behind a legacy and help their future generations to be better off. The idea is, by the third generation of wealth being passed down, […]

While paying online has become easier and more accessible over the years, the COVID-19 pandemic took virtual spending to an entirely new level. As more and more people are embracing this type of spending, the payment options are growing. With that in mind, which virtual payment option may be right for you? Here are seven […]

The role of a financial planner is to help you and your family figure out how to best save earnings, retain value, grow holdings and meet long-term financial goals. Planners should provide short- and long-term expectations with the same portfolio, which can be quite an undertaking. The value of the planner is that he or […]

The CARES and SECURES Acts offered financial relief during COVID-19. And though some of the benefits of these acts are no longer in effect, some of the rules within them were enacted as permanent changes in 2021. In this article, we will look at how these changes affect RMDs in 2021. Keep in mind that […]

Preparing a strategy that is both advantageous and tax-efficient might feel daunting at first. Thankfully, there are some things you can do now to keep from overpaying this tax season. Build Your Team of Professionals You might build a team for any number of pursuits, from organizing a baseball team to putting together people to […]

At different periods of time, the stock market appears to favor one of two stock types – value stocks or growth stocks. Since the 2008 market downturn, for example, the market has primarily favored growth stocks. But some big names are speculating that value stocks could be making a comeback due in part to big […]

As a parent, you know that time with your kids can go by in the blink of an eye. So whether you are preparing to send your child to kindergarten or are dealing with teenagers, it’s never too early (or too late) to start planning for their higher education. Not sure where to start? We’ve […]

The importance of proper estate planning shouldn’t be understated, as it can be a lasting gift for your loved ones after your passing. The discomfort in talking about plans after death or incapacitation may cause certain myths and misconceptions to circulate. Many people plan their estates diligently, with input from legal, tax and financial […]

There are a lot of questions about President Biden’s Build Back Better plan and potential tax law changes, including an adjustment to capital gains taxes. One of the proposals Congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law. Another would raise the capital gains tax […]

Did you know you may be able to take your 401(k), 403(b), or 457 plan and roll it into another type of retirement account while you are still working? Let’s look at how these rollovers can happen and the pros and cons of making them. To start, some basics. Distributions from 401(k) plans and most […]

Estate planning is an often complex financial process that nearly all investors should consider. It includes reviewing legal and tax implications, investment strategies and personal questions to ensure your estate is set up efficiently. As we ring in 2022, let’s look at some of the most important estate planning documents you should have prepared. Wills […]

A living trust is a popular consideration in many estate strategy conversations, but its appropriateness will depend upon your individual needs and objectives. Learn more about what a living trust is and some of the potential benefits of a living trust to help you determine whether a living trust is right for your situation. What […]

The tax season is officially here. If you haven’t already, now is the time to get prepared. Whether you meet with a tax professional or prepare your taxes yourself, proper planning helps the processes go more smoothly and may reduce the risk of costly errors. Check out the tips below and prepare to tackle this […]

As you plan for retirement, it’s exciting to think of all the things you’ll have time to do, including traveling more, spending time with family, and even picking up a new hobby. However, in planning for retirement, you have to also plan for the number of expenses along the way. While you might plan for […]

Introduction When it comes to your financial future, there are lots of things you cannot control such as the stock market, the economy, or major world events. To increase your odds of financial success, it is more important to focus on the things you can control. Understanding Social Security benefits and making the decision about […]

If you saved for retirement in a tax-deferred account, you lowered your taxes in the years you contributed pre-tax dollars. When you get into retirement and start to withdraw those funds, the taxes will be due. And once you reach age 72, you’ll be subject to required minimum distributions (RMDs) to ensure that you take […]

More Money More Problems? Complex Compensation Requires a Different Kind of Advisor The benefit of becoming a high earner is apparent: more money. You can go beyond creating financial security for yourself and your family and start making choices that may have been out of reach. Not having to worry about covering the basics can […]

Pre-retirement planning is one of the most challenging stages of your financial journey. You’re still fully engaged in your career, but you’re also looking ahead to a not-distant future when your life and your source of income will radically change. Retirement means you’ll be making choices about where you want to live, what your retired […]

Whether your 65th birthday is on the horizon or decades away, understanding the different parts of Medicare is critical. Increasingly, Americans are incorporating this government-sponsored program into their future health care decisions, and for good reason. Learn about the different parts of Medicare to determine what plans will work for you and your health care […]

Planning ahead for the care you’ll need when you can no longer care for yourself is one of the most necessary parts of a comprehensive financial plan. It combines two of the most important factors of risk management: ensuring your needs are met in the way you want them to be, and that funding is […]

Inflation is driving the headlines and wreaking havoc on budgets. But for long-term investors – mostly everyone – short-term inflation isn’t the biggest risk to financial plans. Volatility is. It’s being fueled by the Federal Reserve’s efforts to balance bringing down inflation with keeping the economy out of recession. The Fed is raising the key […]

Retirement during a volatile market is unsettling. Whether you are on the cusp or have already made the leap, a market downturn’s impact on your savings will be felt now and potentially for years to come. How do you keep your plan on track and your desired lifestyle in place? If you can’t control income, […]

Do you dream of retiring before you turn 60? How about before you turn 50? If so, you might want to think twice before you make the move. If your heart is set on leaving work early, be sure you leave with the right mindset and the right estimation of your financial potential. Retire with […]

Whether it builds gradually or something happens to spark it – there’s a moment in adulthood when you realize that you need to care for the people that cared for you. Getting a plan in place to care for your parents means balancing your respect and love for them with their autonomy and independence. […]

Creating a retirement paycheck that generates the income you need while keeping you in the lowest possible tax bracket isn’t as easy as it seems. All the planning you did while working – like saving retirement funds in tax-deferred accounts and diversifying by purchasing a second home, can turn into tax bombs as you move […]

You saved diligently, invested carefully, and now you have a sizeable nest egg that can most likely replace 80% of your pre-retirement income. Why should you go through the tiresome process of creating a budget? No matter how carefully you plan, many things are out of your control that can impact the income your plan […]

Should you have disability insurance? A sobering statistic from the Social Security Administration (SSA) might be helpful: the SSA reports that a 20-year-old has a more than one-in-four chance of becoming disabled before reaching retirement. Social Security Disability Insurance (SSDI) is part of the social security tax you pay each year that you work. But […]

Trusts used to be seen as an estate planning tool for only the very wealthy, who have complicated family situations to sort out, and high-value assets to protect. Times have changed. Modern lives are complicated, asset values are high, and good estate planning is for everyone. Let’s look at typical couple: Jean and […]

Determining the right investment plan for you usually comes at the end of your financial planning process. After an extensive review of your current situation, assets, debt, income, and future goals, the final step is to select the correct mix of investments. This is your asset allocation, and it is designed to keep your plan […]

Given the sheer number of cars on the road and the distractions drivers deal with every day, the chances of using your auto policy are higher than ever. You’re at risk literally every single day you get in your car. It’s important to understand what your coverage options are, not just for your car but […]

Inflation has been hitting everyone’s wallets all year long. With the cost of everything from fuel to pasta going up, a 40-year high in the cost-of-living-adjustment (COLA) for social security sounds like a good thing. But is that all there is to it? The answer is complicated. For those already retired or considering retiring […]

Investing can take many forms, and an investment plan often changes throughout your financial journey. But one of the core principles of building a portfolio remains, regardless of your investment strategy’s time horizon, risk profile, or goal. Diversification can help smooth out investment returns over time by allocating assets that react differently to the same […]

Whatever your reason for giving this year, it’s important to know how your charitable contributions can impact your financial plan. In fact, being strategic and intentional with your charitable contributions can create tax benefits for both you and your chosen charity. Here’s how. Research Charitable Organizations Maximize the impact your monetary donation can have by […]

You can’t read about investment for very long without hearing about inflation. The concept may be a little difficult to understand, but at its most basic, it comes down to the following: prices rise over time, causing your money to lose some purchasing power. If you could buy a car in 1980 for $5,500 and […]

In the final days of 2022, Congress passed a new set of retirement rules designed to make it easier to contribute to retirement plans and access those funds earmarked for retirement. The law is called SECURE 2.0, and it’s a follow-up to the Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in 2019. […]

The markets are starting to feel like Groundhog Day. Almost every month, it’s a cadence of employment numbers, CPI, Fed, — market reacts. With inflation starting to trend down, even if only slightly, optimism has been making a comeback. That means moving our analogy to another charming rodent. It seems like the Fed is playing […]

One of the biggest challenges of planning for retirement is figuring out how much you can spend during your golden years. Retirement income planning requires careful preparation, and budgeting. A popular retirement income planning guideline is the 4% rule, which suggests that you live off 4% of your total investments during the first year of […]

The monthly Fed/CPI/Employment headline-market movement industrial complex was rudely shouldered aside in the last week by a much bigger and faster-moving story. While the fallout from bank failures will take a while to unravel, and the impact on markets will likely be ongoing, the bigger picture wraps right back to the Federal Reserve. But first, […]

March Recap and April Outlook Equity markets, using the S&P 500 index return as a proxy, at first glance appear to have shrugged off the mid-month drama of multiple domestic, regional bank failures and the forced sale of a massive Swiss bank. Attention was temporarily diverted from the economy’s star attractions, CPI and the Fed, […]

April is Financial Capability Month, an initiative that started in 2004 as “Financial Literacy” and has evolved over the last 20 years. The rebrand reflects a trend of taking a more active approach to finances and a focus on having more control over decision-making as you move through your financial journey. As you become […]

Are you thinking about your taxes and financial strategies for 2026? If not, you should be. In 2026, a number of tax adjustments that were enacted as part of the 2017 Tax Cuts and Jobs Act (TCJA) are anticipated to expire. For affluent couples, the most consequential change is likely to be a substantial reduction […]

Extended care, also known as long-term care, can be a significant financial burden for many families. Costs are not straightforward and can include expenses such as in-home care, assisted living facilities, and nursing homes. These add up quickly and may not be fully covered by insurance or government programs. But there are several cost-saving strategies […]

As you become successful in your career, buy a home, save, and invest, you’re building knowledge and capability. But are you gaining the ability to achieve your own goals? True financial capability is closely tied to financial independence; however, you define that. For many people, it relates to flexibility and making choices as an […]

Early retirement may seem like a dream come true. However, you need to be well prepared if you want to retire early. If you’re not prepared, you might run into complications. Here are a few things to consider before retiring early that no one talks about. Will You Have Enough Money for Your Entire Retirement? […]

Equity compensation is an attractive benefit that many companies offer to employees. It can be a valuable way to reward and motivate employees by giving them a share of the company’s ownership. If you’re new to equity compensation or simply looking to learn more, you’ve come to the right place. In this article, we break […]

The traditional retirement age in the United States is 65, the age at which most people are eligible to begin receiving full Social Security benefits. But many people feel the allure of leaving the workforce much sooner. Many Americans are deciding to retire earlier than planned, whether by choice or because of other circumstances. According […]

Receiving Social Security benefits is advantageous in retirement, but like almost every other form of income, these benefits are taxed by the government. To accurately predict your retirement income (and taxes), it’s important to understand how Social Security benefits are taxed. Here, we explain everything you need to know about Social Security benefit taxation. How […]

The Roth-Only Catch-Up Contribution Rule Will Get Time to Catch Up The SECURE 2.0 Act, which was passed in December 2022, made a significant change to the IRS catch-up contribution rules. The catch-up contribution allows those aged 50 and above to contribute an additional $7,500 to an employer-sponsored pre-tax retirement plan. SECURE 2.0 tied that […]

Investing strategies consist of a few different types of financial theories. This article examines two popular theories you may have heard of: modern portfolio and behavioral finance theory. Modern Portfolio Theory (MPT) Modern portfolio theory, also called mean-variance analysis, is a widely used model for structuring your investment portfolio. MPT was developed by Nobel Laureate […]